Environmental, Social, and Governance (ESG) investing has gained significant momentum over the past few years as more investors seek to align their portfolios with their values. ESG investing goes beyond traditional financial metrics by incorporating non-financial factors that can impact a company’s long-term performance and societal impact. This approach to investing is transforming the financial landscape by encouraging companies to adopt sustainable practices while providing investors with opportunities to generate returns without compromising their ethical standards.

Understanding ESG Investing

ESG investing is based on the idea that companies with strong environmental, social, and governance practices are more likely to succeed over the long term. The environmental component focuses on how a company’s operations impact the planet, such as its carbon footprint, waste management practices, and resource usage. The social aspect examines a company’s relationships with employees, customers, and communities, including issues like labor practices, diversity and inclusion, and community engagement. Governance refers to the quality of a company’s leadership, transparency, and adherence to ethical standards.

Investors are increasingly recognizing that these factors can have a significant impact on a company’s financial performance. For example, a company that fails to manage its environmental risks may face costly fines, reputational damage, and declining customer loyalty. Similarly, companies with poor governance may be more prone to scandals, fraud, and mismanagement, which can erode shareholder value. By integrating ESG criteria into their investment decisions, investors aim to identify companies that are well-positioned to thrive in a changing world while avoiding those that may be exposed to risks that could harm their long-term performance.

The Growth of ESG Investing

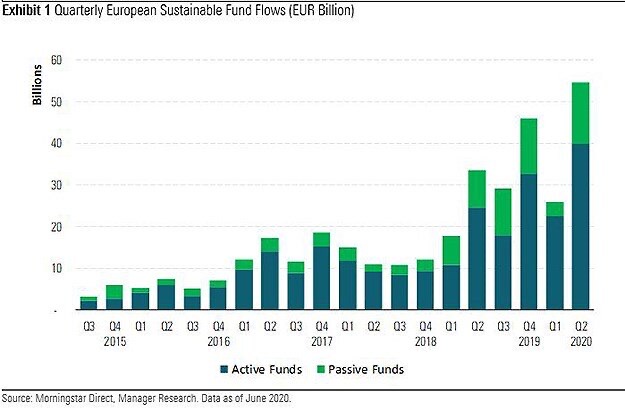

The growth of ESG investing has been driven by a combination of factors, including increasing awareness of global challenges like climate change, social inequality, and corporate misconduct. Investors, particularly younger generations, are demanding more transparency and accountability from the companies they invest in. This shift in investor preferences has led to a surge in the number of ESG-focused funds and investment products, offering a wide range of options for those looking to incorporate ESG principles into their portfolios.

Institutional investors, such as pension funds and insurance companies, are also playing a crucial role in the rise of ESG investing. These large investors are increasingly integrating ESG factors into their investment processes as they recognize the potential financial risks and opportunities associated with sustainability issues. As a result, companies are under growing pressure to improve their ESG performance to attract capital and maintain their competitiveness in the market.

Balancing Profit with Purpose

One of the key debates surrounding ESG investing is whether it requires sacrificing financial returns for social good. However, research suggests that ESG investing does not necessarily mean lower returns. In fact, companies with strong ESG practices often demonstrate better financial performance over time. This is because they are better equipped to manage risks, adapt to regulatory changes, and meet the evolving expectations of consumers and investors.

Moreover, ESG investing allows investors to contribute to positive social and environmental outcomes while pursuing their financial goals. By directing capital toward companies that prioritize sustainability and ethical practices, investors can play a role in driving corporate behavior and promoting a more sustainable and equitable future.

Conclusion

The rise of ESG investing reflects a growing recognition that financial performance and social responsibility are not mutually exclusive. By balancing profit with purpose, ESG investing offers a powerful tool for addressing global challenges while generating long-term value for investors. As this trend continues to gain traction, it is likely to reshape the investment landscape and redefine the role of capital markets in promoting sustainable development.